| Shaky valuation method to cost expats more on taxes | ||

|

The unusual way that Costa Ricans appraise property is coming to haunt expats who own dwellings here. At a time when some properties are selling at give-away prices, the finance ministry has set new assessment values based on the rising price of construction materials. That means a higher value that might put more homes into the luxury category where the owners have to pay an extra annual tax and opens the way for municipalities to adopt these values for local taxes. The Dirección General de Tributación, the tax agency of the Ministerio de Hacienda, released the new value without any fanfare. The decree ended up in an obscure part of the La Gaceta official newspaper Thursday. The edict continues the government's reliance on the appraisal system called replacement cost new less depreciation. This is in wide use in Costa Rica even though many appraisal texts call this unreliable except in special cases. In this system the appraiser measures the area of a structure and tries to determine based on current prices how much the cost would be to replicate it. Once the estimated cost new is determined, the appraiser applies a deduction for actual depreciation, that is the wear and tear, and the statutory depreciation, that is the amount the government will allow. This system of appraisal appeals to the Costa Rican sense of order and allows them to ignore what may be the actual market value of a property. The true value of a property is what someone will pay to buy it, and the more reliable market data approach compares a property to recent sales of similar structures that actually have taken place. Under the government system, a 400-square-meter concrete home in a San José slum would have the same value as one sitting on a hill overlooking the Pacific Ocean in a community like Dominical or Tamarindo. The government tries to compensate for this by issuing estimated values for square meters of land in different parts of the country, but the adjustment seldom is sufficient to offset the replacement cost approach. The Tributación edict also includes hotels, whose struggling owners will have to pay the same luxury tax as homeowners. But hotels are a business, and appraisers generally try to evaluate an ongoing commercial enterprise by its income and profit. The income approach to value would clearly report that the McDonald's fast food operation on the downtown pedestrian mall is worth much more than the value of its bricks and mortar. And that approach also would say that a southern Costa Rica hotel that is standing empty and unused is worth far less than the cost of constructing it. The decree appears to increase the square-meter value of dwellings as much as 40 percent. That |

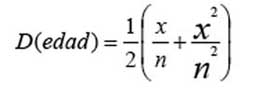

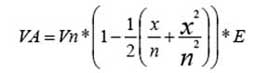

means some homeowners whose properties were not subject to the luxury tax in the past are now. Most expats will need help with the tax assessment. The declaration of value, which the homeowner must make, is good for three years. Since the tax is three-years-old, those who have been paying the tax based on 2009 figures must report a new value based on the new data issued by Tributación. The declaration can be submitted via the tax agency's electronic system. Or it can be handed in on Form D-179. In any case, the math to determine the value of a dwelling or a hotel or a condo is challenging. The good news for some homeowners this year is that the threshold for paying the so-called luxury tax has increased from 100 million to 111 million colons or about $224,470. In part this is due to the increased value of the colon against the U.S. dollar. That includes the estimated value of the lot. Condo owners also have to include their proportional share of the common areas. Editor Brodell has conducted a number of property appraisals in his long career. He has been admitted as an expert witness on the value of newspaper properties in a U.S. state court. | |

..

No comments:

Post a Comment